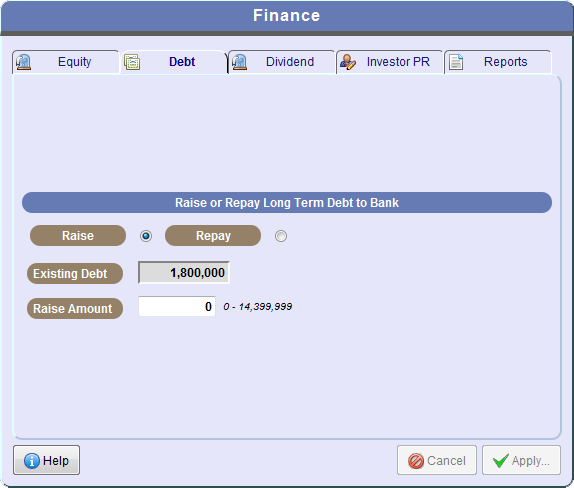

Finance Decision Screen - Debt

See also:

Finance Decision Screen - Equity and Dividends

Finance Decision Screen - Investor PR

The Finance Decision Screens allows you manage the cash your firm has available to it by paying dividends to your shareholders, raising or repaying long-term debt, issuing or repurchasing equity (i.e. shares in your firm), and setting a budget for Investor Public Relations.

To raise more debt, select the Raise button and then type in the dollar amount by which you wish to increase your debt in the Raise Amount field. If you attempt to raise so much debt that your firm's debt/equity level is above a certain level, then you will be informed that financial institutions are refusing to lend you the money because they consider it too risky.

To repay debt, select the Repay button and type in the dollar amount of debt you wish to repay in the Repay Amount field. You may not repay more debt than you currently have as shown in the gray Current Debt box. You may not both raise and repay debt in the same decision period.

A (limited!) overdraft facility has been arranged which will help to smooth over any miscalculations in cash flow. (The interest rate is 10% and the limit is 25% of the value of book equity.) Firms which exceed this overdraft limit are placed under statutory management and must pay additional legal fees as they struggle to stay afloat.

When competing in MB-A Multi-player, it is possible that your firm will be bought out by another. In this case you may incur debt from them as opposed the bank and negotiate the interest directly with them. These decisions are made in the lower part of the decision screen.